The print and drawing centre at the Art Gallery of Ontario in Toronto houses more than 100,000 items in a two-storey, climate-controlled vault. With a bit of reorganizing of the shelves and boxes, there would be room for more – just. “It’s a Tetris game,” says chief curator Julian Cox, who also oversees the 12,000 paintings and sculptures stored in the sub-basement vaults below.

Only about 2 per cent of these treasures are on public display, but the AGO acquires new art aggressively. It subsumed the Thomson family’s 2,000-piece collection of Canadian and European art in 2008, arranged the purchase of 522 photographs by Diane Arbus in 2016, and in 2019 acquired a 3,500-piece collection of Caribbean photography. (The Globe and Mail is owned by Woodbridge, the investment arm of the Thomson family.)

To show more modern art, it is now building a 3,700-square-metre extension at the back of its Dundas Street headquarters, a space that will be almost entirely devoted to exhibition galleries. This will be the third AGO expansion in three decades.

An art museum’s role is to preserve the art of the past and collect the art of the present. It’s not doing its job if it’s not regularly acquiring both historical and contemporary art, not only to display but also for research purposes.

And yet, exhibition space and storage space are finite. Most art museums are playing Tetris all the time, but recently the game has gotten particularly tense. Canadian public art collections have ballooned in the past two decades and, with added political and social demands to show both more and different art, the pressure on storage and conservation only grows. When is enough enough … or simply too much?

“One cannot imagine a world where museums just keep storing and storing and storing and storing indefinitely,” said Stéphane Aquin, director of the Montreal Museum of Fine Arts, where he oversees a collection of 47,000 objects. About 5 per cent or 6 per cent is currently on display. “The pressure is on institutions to maintain storage, and to permit these works that we acquire to live and not just be dumped into what is basically their cemetery.”

It’s in the nature of any healthy museum to keep collecting, changing and growing, but Canadians are also greatly encouraged to donate art to favoured public institutions: Donors are offered generous tax breaks on gifts of cultural material deemed significant by a government-appointed board of experts. That system is so successful, collection creep has proved inevitable.

In 2019, the Canadian Association for Conservation of Cultural Property (CACCP) and the Canadian Association of Professional Conservators issued a report sounding the alarm about the conditions under which Canada’s cultural heritage is being kept. They had surveyed almost 400 institutions, mainly museums and archives, but also art galleries, libraries and historic sites. About half reported overcrowding in storage, to the point where objects were at risk. Five years later, the federal government is busy reworking its museum policy and Gyllian Porteous, president of CACCP, said Ottawa has still not addressed the groups’ conservation concerns.

“If you scratch the surface, you find that across the country, we just don’t have enough storage space or adequate storage spaces for many of these collections,” said Nancy Noble, director of the Art Gallery of Greater Victoria. It’s an institution with a large Asian art collection that is branching out into contemporary art – and just starting to plan a move to a new facility.

Along with a lack of fire sprinklers and security alarms, the conservation survey uncovered another startling fact: About half of the respondents said their collections had doubled or more than doubled in the past 20 years. Canadian art museums have infrastructure problems because they have so much stuff.

Workers in Ottawa prepare the new roof of the National Gallery of Canada in 1986, in a decade where art museums faced growing pressure to acquire more art.Tibor Kolley/The Globe and Mail

There are various social trends that may be responsible: Art museums have been gaining popularity since the 1980s and today’s institutions are often highly successful in positioning themselves as the setting for both wholesome family outings and glamorous Instagram shots. Meanwhile, the pressure to show something more than the work of dead white men – the art on which conventional public collections were founded – forces the museums to expand into new territory by acquiring lots of work by a more diverse group of contemporary artists as well as pieces by neglected historical artists.

Still, there is one specific reason why Canadian public art collections keep growing: tax credits. In the 1970s, Canada finally realized that it was bleeding cultural property. The great Montreal collections of the 19th century, including much of the art owned by railway magnate William Van Horne, had been lost to foreign auction sales in the prewar years. The government created the Canadian Cultural Property Export Review Board to block the export of important art by private individuals until Canadian museums had a chance to buy it.

The government then established a system of special tax credits for any cultural property deemed to be of outstanding significance, creating a big incentive to donate art. Today, CCPERB’s board is responsible for certifying cultural property, most of which is fine art donated by collectors in Ontario and Quebec. For the past five years, it has examined more than 1,000 objects or groups of objects annually and certified on average $70-million worth of art. It issues tax credits accordingly, calculating that represents about $20-million in forgone federal income taxes every year. (That low-ball figure does not include taxes on capital gains the government may have forgone and assumes donors are not in the top tax bracket.)

Daphne Odjig's Thunderbird Man, a donation to the Royal Ontario Museum, is one example of a work certified by CCPERB under the Cultural Property Export and Import Act.Brian Boyle, MPA, FFPO/Royal Ontario Museum

In Canada, credits for charitable donations, representing 29 to 33 per cent of the gift’s value, can be deducted from taxes owing, up to an amount equivalent to 75 per cent of net income. But when a taxpayer donates CCPERB-certified art to a recognized institution, that limit rises to 100 per cent of net income. That is why the AGO sometimes makes acquisitions by asking a philanthropist to buy the art and donate it back to the gallery rather than simply contributing the cash. The museum gets the art; the donor gets a more useful tax credit.

Meanwhile, for collectors who have held on to art through the years, the donation of certified art can be almost as attractive as selling because it avoids taxation on a capital gain. (In Canada, donors are taxed on capital gains on other gifts in kind, such as uncertified art or real estate.) No wonder the AGO has 10 times more offers of gifts than it can accept.

The U.S. has a similarly generous system, although its process is more streamlined. Britain’s system is less generous, and most European countries don’t offer these tax credits at all. However, Canada is the rare Western economy without an inheritance tax: It is standard in Europe to donate art to the state in lieu of death duties.

A curatorial fellow works on an installation at the AGO, which, according to a 2020 report by the Ontario auditor-general, was the single largest recipient of art donations through CCPERB.Christopher Katsarov/The Globe and Mail

If the purpose of CCPERB is to move art from private collections to public ones, the system is a winner. Every year, hundreds more objects worth millions of dollars are transferred to the public realm. There is no cap on how much can be donated in any given year.

When Ontario’s auditor-general did a first-ever value for money audit on the Art Gallery of Ontario in 2020, it noted that the AGO was the single largest recipient of donations through CCPERB, and that its collection had grown 23 per cent in the previous five years.

It rapped the gallery on the knuckles for giving preference to donations from its board members and accepting art that it did not show. “Despite the cost to taxpayers of the AGO’s acquisitions, we found that the AGO has not displayed the majority of these donations that it has received in the last five years that were certified by CCPERB. In addition, the AGO has not experienced a significant increase in its attendance as a result of these donations.”

This represents a misunderstanding of how and why museums, experts in the long game, acquire art: Some pieces may be more important to researchers than the public; some pieces may be part of exhibition planning that won’t see the light of day for years.

But the comment is a revealing one because it represents the pressure on museums, in a pluralist era, to show more of their collections.

“We need more space to show art,” said AGO director Stephan Jost. “We need more space to show a broader history of art, a more inclusive history. I’m not trying to be politically correct, but it’s just great, great things that haven’t seen the light of day.”

AGO director Stephan Jost laments the fact that there is not enough room to show 'a more inclusive history' of art.Fred Lum/The Globe and Mail

If space is at a premium but new acquisitions are a must, one solution is to sell off some of the older art. In the museum field, deaccessioning, as it is known, is only permitted for the purpose of buying more art, not to keep the lights on. However, attitudes were already loosening internationally before the pandemic caused many museums big financial losses. Increasingly, deaccessioning is used not only to buy art but also to research or conserve it. Museums pressed to show a more diverse collection have started selling historic pieces to buy newer ones.

For example, last November, the Beaverbrook Art Gallery in Fredericton auctioned off a seaside scene by the mid-century British painter L.S. Lowry to raise more than $1-million to spend on Canadian art. The sale of a painting that was part of Lord Beaverbrook’s original gift raised some eyebrows but chief curator Ray Cronin said the collection, with strong examples of British art, including works by J.M.W. Turner, Thomas Gainsborough and the 20th-century figurative painter Stanley Spencer, was already considered conservative when it was donated in 1959 and needs to engage the local community.

“The makeup of Canada changes; we’re much more diverse. It’s not just England, the United States and France that people want to see art from,” he said. “We are never taking down our Turner; we are never taking down our Gainsborough but … we don’t need to have 30 examples of works by Lowry or Stanley Spencer.”

To date, the Beaverbrook has spent about a third of the money, which represents one of the most significant acquisitions of art since its founding. The highlight of 34 purchases is Zombie Fires Burning, a new painting about environmental degradation by the Cowichan/Okanagan artist Lawrence Paul Yuxweluptun.

The Beaverbrook Art Gallery in Fredericton was willing to part with L.S. Lowry's Beach Scene, Lancashire, so the proceeds could be spent on different artworks.Beaverbrook Art Gallery

One of the Beaverbrook's acquisitions was Zombie Fires Burning by Lawrence Paul Yuxweluptun, a First Nations artist of Cowichan and Okanagan descent.Beaverbrook Art Gallery

Despite the auditor’s complaint about the AGO, new acquisitions increasingly get pride of place at art museums. This fall the MMFA is unveiling a special exhibition of purchases and donations from the past five years with a stress on their diversity, while the AGO now refreshes its permanent collection displays regularly.

“The issue is not so much about percentages, but what you are showing,” Cox said. “What is the reward for the public?”

Of course, the most obvious way to show more art is to create more space, and Canada’s art museums, many still housed in repurposed heritage buildings, always seem to have building campaigns on the go.

“The pressure [to show more art] is not only from outside. I think it’s from inside too,” said Eva Respini, deputy director at the Vancouver Art Gallery, which is hoping to build a much delayed purpose-built home. “That’s why we’re building a new building because currently we don’t have galleries dedicated to the permanent collection.”

While the AGO is busy building the Dani Reiss Modern and Contemporary Gallery, the Art Gallery of Greater Victoria, currently situated in a gracious old house in the leafy Rockland neighbourhood, is about to launch a campaign that would see it move to a new building in a redevelopment of that city’s downtown waterfront.

In 2022, the Nova Scotia government paused a plan to finally move the Art Gallery of Nova Scotia to a purpose-built facility because of rising costs, and the MMFA is an unusual case because it decided unilaterally to pull out of an expansion. In 2020, it cancelled a project to house a centre devoted to the Quebec modernist Jean-Paul Riopelle, deciding that closing the entire Desmarais Pavilion to build an addition on its roof was too disruptive and expensive. Instead, the Musée National des Beaux Arts in Quebec City took over the opportunity to house 60 artworks worth $100-million donated by the Jean-Paul Riopelle Foundation. It plans to open that new centre next year.

The Beaverbrook, meanwhile, opened the new Harrison McCain Pavilion in 2022, unveiling a larger display of its permanent collection, including recent gifts and purchases. “It’s a beautiful and useful exhibition space,” Cronin said. But he adds that nobody is going to give the art gallery $5-million for the unglamorous task of building more storage.

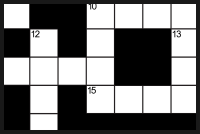

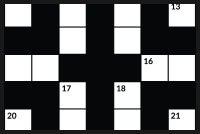

If I sell or donate art to a museum, what do I earn and what do I save? Two tax scenarios

Canada has a generous system to encourage the donation of outstanding art to designated public institutions. Here’s an example of how it worked for years before the new capital- gains rules came into effect in June.

About the collector

Mira is a wealthy Canadian and Ontario resident who owns a Lawren Harris painting she bought for $100,000 in the 1980s. In 2023, she had an annual income of $500,000; after the basic personal exemption, she paid an estimated federal and provincial tax of $225,971.

Scenario A: Mira sells the painting

The process

When Mira sells her painting at auction, the hammer goes down at $1.2-million. She pays the auction house a seller’s premium of about 10 per cent, so nets $1.1-million. Deducting the original purchase price, she is left with a capital gain of $1-million of which $500,000 is taxable as income. (After June 25, 2024, $625,250 would be taxable.) With this extra $500,000 income, she’ll pay $267,648 more taxes.

The bottom line

By selling a $1.2-million painting, Mira makes about $732,352, realizing less than two-thirds of its market value.

Scenario B: Mira donates the painting

The process

In donating the painting to a listed institution, Mira has it certified as significant cultural property by the Canadian Cultural Property Export Review Board. At minimum, its fair market value could be expected to be appraised around $1.2-million (although a more generous appraisal might put it at $1.44-million, the price it could have achieved at auction plus the buyer’s premium of 20 per cent.)

She gets tax credits calculated on a $1.2-million gift: In her tax bracket, she will be credited 33 per cent of $265,000 (the amount of her taxable income over $235,000) and 29 per cent for the rest of the gift, up to a value of 100 per cent of her net income. She also saves on her provincial taxes, credited to 11.16 per cent of the gift.

She saves an estimated $492,520 in taxes, and has five years to use the credits.

The bottom line

By donating a $1.2-million painting, Mira will forgo $239,832 – only a third of the profit she could have realized and only a fifth of the painting’s market value. Mira makes a $1.2-million gift but it only costs her $239,832.

The federal and Ontario treasuries will forgo an estimated $760,168: $133,920 provincial income tax, $358,600 federal income tax, and $267,648 in extra federal and provincial income taxes that Mira would have had to pay had she realized the capital gain.

The Canadian canvas: More from The Globe and Mail

The Decibel podcast

Nine years ago, to much fanfare, the Vancouver Art Gallery acquired 10 sketches that seemed to be lost Group of Seven originals – but they were fakes, a fact the gallery kept from the public until last winter. Globe columnist Marsha Lederman spoke with The Decibel about how the mystery was solved. Subscribe for more episodes.

Kate Taylor on visual arts

Mohawk artist Shelley Niro goes bold and brassy in 40-year career

Historian digs into Paul Kane’s problematic images of Indigenous people

Quebec Impressionism, from bustling cities to bucolic villages

The unlikely story of how a Fellini memorabilia collection came to Toronto