FILE — Sam Bankman-Fried, the chief executive of cryptocurrency exchange FTX, during a panel at Crypto Bahamas conference in Nassau, Bahamas, on April 27, 2022. FTX filed for bankruptcy in November, and Bankman-Fried was arrested this week. (Erika P. Rodriguez/The New York Times)ERIKA P. RODRIGUEZ/The New York Times News Service

Getting caught up on a week that got away? Here’s your weekly digest of The Globe’s most essential business and investing stories, with insights and analysis from the pros, stock tips, portfolio strategies and more.

The FTX FOMO was real, until it wasn’t

Global institutional investors, including the Ontario Teachers’ Pension Plan, poured more than a billion dollars into FTX, helping seal its leading position in the sector and Sam Bankman-Fried as the golden boy of crypto. After the bankrupted crypto company’s startling collapse in November, police in the Bahamas arrested Mr. Bankman-Fried this week on U.S. charges of criminal fraud and conspiracy. He said in court on Tuesday he will fight an extradition. But how did nobody see this coming, and did anyone raise any red flags? Temur Durrani takes a deep-dive into how big-name investors, including Canadian pension funds and Kevin O’Leary, bought into a crypto craze that ended up with criminal charges.

Scotiabank’s suspicious cash-back offer to switch to a fixed-rate mortgage

Banks have long used cash incentives and other signing rewards to promote products ranging from credit cards to bank accounts, but when a Bank of Nova Scotia client recently received an offer to lock in his adjustable mortgage rate with a cash-back incentive, it unwittingly caused an internet uproar. As Erica Alini reports, Daniel Goldsmith took to Reddit wondering whether the bank was using the financial incentive of $1,200 cash-back to nudge him toward a 5.47-per-cent fixed-rate mortgage. He also wondered whether the bank wanted him to sign up for a fixed rate because it expected interest rates to start falling in coming months. For borrowers like Mr. Goldsmith, whose mortgage instalments have been rising with every rate increase, the past nine months have been a painful financial squeeze. But if interest rates fell during the rest of Mr. Goldsmith’s mortgage term, his payment would also shrink.

Canadians are retiring early – and becoming outliers

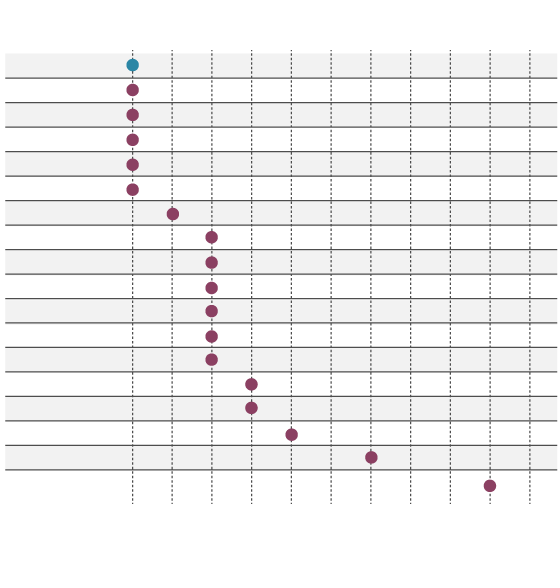

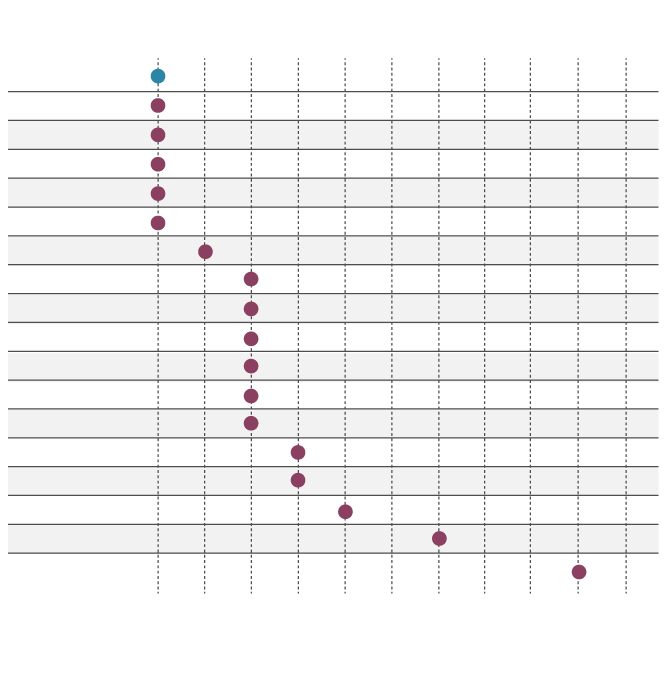

The earliest age when people can retire and access CPP/QPP and Old Age Security in Canada is 65, yet increasingly, that age is considered young. As Frederick Vettese points out in this week’s Charting Retirement, many countries have raised the normal retirement age to reflect longer lifespans, and later retirement ages are usually phased in over many years to give people a chance to adjust. The chart below shows the normal retirement age after each country’s “phase-in” is complete.

Normal retirement ages in OECD countries

Canada

France

Japan

New Zealand

Sweden

Switzerland

Ireland

Australia

Belgium

Germany

Norway

Britain

U.S.

Finland

Portugal

Netherlands

Italy

Denmark

65

66

67

68

69

70

71

72

73

74

75

the globe and mail, Source: frederick vettese; OECD Pensions

at a Glance, 2021

Normal retirement ages in OECD countries

Canada

France

Japan

New Zealand

Sweden

Switzerland

Ireland

Australia

Belgium

Germany

Norway

Britain

U.S.

Finland

Portugal

Netherlands

Italy

Denmark

65

66

67

68

69

70

71

72

73

74

75

the globe and mail, Source: frderick vcettese; OECD Pensions

at a Glance, 2021

Normal retirement ages in OECD countries

Canada

France

Japan

New Zealand

Sweden

Switzerland

Ireland

Australia

Belgium

Germany

Norway

Britain

U.S.

Finland

Portugal

Netherlands

Italy

Denmark

65

66

67

68

69

70

71

72

73

74

75

the globe and mail, Source: frederick vettese; OECD Pensions at a Glance, 2021

Interest on debt payments hit record

Canadian debt payments are rising while our household wealth is taking a tumble, writes Matt Lundy. Households made about $57.4-billion in debt payments during the third quarter, a record quarterly increase of 6.1 per cent, according to Statistics Canada data. The interest portion of debt payments jumped by 17.8 per cent – also a record – from the Bank of Canada rapidly hiking interest rates in an attempt to bring inflation under control. The turn in monetary policy has shaken up personal finances. Canada’s household debt burden – the ratio of credit market debt to disposable income – rose to 183.3 per cent in the third quarter, from 182.6 per cent in the second quarter. The ratio is nearing the record high set in 2018: 185 per cent. Meanwhile, Canada’s household net worth – the value of all assets minus liabilities – fell by around $330-billion during the third quarter, after a record quarterly decline of more than $930-billion between April and June.

Former CannTrust officials found not guilty in unlicensed cannabis trial

An Ontario judge ruled this week that three former high-ranking officials from CannTrust Holdings Inc. were not guilty of any charges brought against them by Ontario’s securities regulator, bringing an abrupt and final close to a trial that ended almost as soon as it began. As Greg McArthur reports, the prosecution of former CannTrust chief executive officer Peter Aceto, former chairman Eric Paul and former director Mark Litwin collapsed after a key government witness conceded that the fundamental allegation against the trio – that they permitted unlicensed growing in eight rooms at the company’s Niagara-area production facility – is incorrect. When the scandal erupted after a 2019 Health Canada inspection, it had wide-ranging implications, including a special committee of CannTrust’s board launching an investigation, class action lawsuits, terminations and the company seeking bankruptcy protection.

Putting the stock in stocking stuffer

Looking for a last-minute holiday present or stocking stuffer? David Berman has put together a stock market gift guide, with suggestions for your dividend-loving dad, the investment thrill-seeker on your list and even a lump of coal for the deserving Grinch.

Now that you’re all caught up, prepare for the week ahead with The Globe’s investing calendar.