Briefing highlights

- House prices: Be afraid

- What to expect in housing report

- A key week for China

- U.S. banks earnings in focus

- Stocks, Canadian dollar, oil at a glance

- Lululemon raises financial forecasts

- What to watch for today

- MLF’s McCain criticizes U.S. over Iran

- What analysts are saying today

- Required Reading

Be afraid. Be very afraid.

— Advertisement for the 1986 horror movie The Fly

Be afraid as Canadian housing markets rebound.

The Bank of Canada certainly is concerned, and is watching as housing continues to perk up after having slumped in the wake of federal mortgage-qualification stress tests that came into effect in early 2018, aimed at heading off any meltdown.

As The Globe and Mail’s David Parkinson reports, central bank Governor Stephen Poloz cited the rebound in a speech last week, raising red flags.

"Should this housing rebound continue, we will be watching for signs of extrapolative expectations returning to certain major housing markets - in other words, froth," Mr. Poloz said.

"The fact is, the fundamental demand for housing appears to be outpacing our ability to build new homes, which can put renewed upward pressure on prices," he added.

"It can be very unhealthy when the situation becomes speculative because it can lead to a sudden downdraft in house prices later, with wider implications for the economy."

The “good news,” as Mr. Poloz sees it, is that the stress tests are taking care of riskier debt.

But that won't stop home prices from rising further, notably in the Toronto and Vancouver areas, pressuring the market and making an affordability crisis even worse in certain centres.

“Owning a home in Vancouver, Toronto and Victoria, in particular, continues to be an impossible dream for many,” said Royal Bank of Canada senior economist Robert Hogue, though affordability has improved somewhat.

“And in Montreal and Ottawa, ownership costs have started to pinch,” he added in his latest report on what it takes to own a home.

"Outside these major markets, however, the bar is generally more achievable."

Consider, for example, that owning a home takes 77.3 per cent of one's income in Vancouver, and 65.6 per cent in Toronto, according to Mr. Hogue.

We’ll get a fuller picture Wednesday when the Canadian Real Estate Association releases its December report on sales and prices.

Benjamin Reitzes, Bank of Montreal's Canadian rates and macro strategist, expects the report to show sales surged 16 per cent from a year earlier.

Average prices are forecast to climb about 10 per cent, the fastest rate since 2016, Mr. Reitzes said, with the MLS home price index up 3 per cent, the fastest in about two years.

We’ve already seen December results from some local real estate boards, highlighting the rebound.

Sales in Toronto, for example, climbed almost 17.5 per cent from a year earlier, while those in Vancouver shot up more than 88 per cent.

"This marked an impressive turnaround from the very weak conditions prevailing at the start of 2019," RBC's Mr. Hogue said in a separate report.

"There’s been increasing evidence since then that buyers have adjusted to earlier policy changes - including the mortgage stress test," he added.

"Modest declines in mortgage rates over the first half of the year also helped spur demand. The bigger issue now is low inventories."

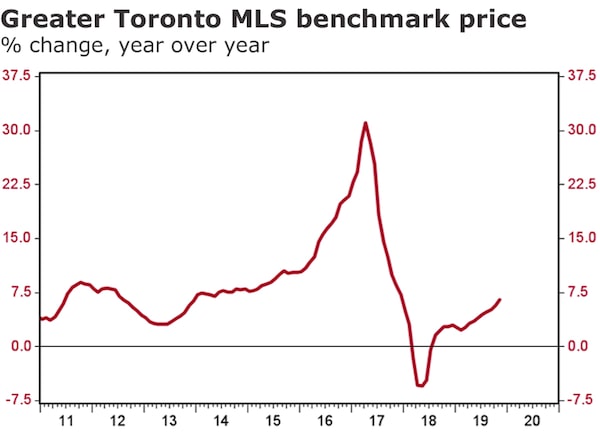

We're not seeing prices rise at the stunning paces that prompted action from the federal, B.C. and Ontario governments. But a close watch is needed.

"While home prices in some major Canadian cities aren’t bubbling away at the 30-per-cent to 40-per-cent clip of early 2017, they are clearly gaining steam," warned BMO senior economist Sal Guatieri, noting Toronto prices jumped almost 7.5 per cent in December from low levels of a year earlier.

Source: Bank of Montreal

As for Vancouver, the benchmark price is still below that of a year earlier.

"But not for much longer - it's been rising month over month over the last five months," said RBC's Mr. Hogue.

"Home prices are poised to maintain an upward trajectory in the period ahead - quite possibly rising above year-ago levels by the spring (or even earlier)," he added.

“After seeing some affordability reprieve over the past couple of years, Vancouver buyers will again find it harder to achieve their home ownership dream in 2020.”

Read more

- David Parkinson: Poloz warns ‘froth’ could return to Canada’s housing market

- Rachelle Younglai: Toronto saw rebound in home sales last year as prices near record levels

- Rachelle Younglai: Vancouver housing recovery accelerates in 2019 as December caps months of strong growth

- Rob Carrick: Exactly how does our shaky economy rate smoking hot housing markets in some cities?

- Oliver Moore: Toronto Mayor John Tory wants a tax hike on homeowners to raise billions for transit and affordable housing

- Home prices to spike next year, but not like the bad old days (or good old days if you were selling)

- Canada oh-so-close to sellers’ market in housing again. Here’s how your city ranks

- Matt Lundy: Homes in Canada are getting more affordable, but it isn’t likely to last

- Carolyn Ireland: Torontonians in search of affordability head west

- Who’s buying $5-million-plus homes in Toronto? More than 100 people so far this year

- Rita Trichur: Frothy housing markets are creating a powder keg for new Liberal minority to defuse

- Yes, you may be able to afford a new home in Toronto. No, you can’t have a backyard

- Pace of mortgage credit speeds up amid ‘fear of a return to bubble-like conditions’

Key this week

It’s a key week for China, which releases several economic readings and, more importantly, is scheduled to sign the “phase one” trade deal with the U.S.

In exchange for killing certain tariff plans and easing other levies, Beijing has pledged to boost its purchases of American agricultural products.

Derek Holt, for one, Bank of Nova Scotia's head of capital markets economics, is dubious.

"It’s unclear whether China had Trump on by securing tariff relief in exchange for targets it knows are some combination of transitory or undeliverable to buy time to the U.S. election, or Trump set China up to fail for another run on enforcement grounds after the election," Mr. Holt said.

"Either way, what’s known about the trade deal to this point is met with deep skepticism."

China also reports numbers on fourth-quarter economic growth, trade, retail sales and industrial production.

Also on tap is the beginning of U.S. earnings season, and major U.S. banks will begin reporting quarterly results.

“One of the main characteristics for U.S. bank earnings in recent quarters is how often they have beaten expectations,” said CMC Markets chief analyst Michael Hewson.

"JPMorgan Chase in particular has been a decent bellwether having posted record revenues and profits in the previous quarters over the past 12 months."

Results from JPMorgan, Citigroup, Morgan Stanley and Wells Fargo "should come in at the higher end of expectations," Mr. Hewson added.

"Goldman Sachs could struggle given its lack of retail exposure, although its margins tend to be better when it comes to its investment banking division."

Read more

Markets at a glance

Read more

Lululemon raises forecasts

Lululemon Athletica Inc. boosted its profit and revenue forecasts as it boasted of a strong holiday shopping season.

It said it now projects fourth-quarter diluted earnings per share between US$2.22 and $2.25, up from its previous forecasts of US$2.10 to $2.13.

Revenue is now projected at US$1.37-billion to US$1.38-billion, compared to earlier forecasts of US$1.315-billion to US$1.33-billion.

Chief executive officer Calvin McDonald cited “momentum in our business over the holiday period.”

Read more

What analysts are saying today

“Equity market sentiment in Europe this morning is positive as traders are looking ahead to the signing of the first phase of the U.S.-China trade deal on Wednesday. The largest economies in the world brokered phase one of the trade agreement at the back end of 2019, and it will be made official in two days’ time. International trade was a dominant theme of last year, but the U.S.-China trade story is far from over seeing as the second phase of the trade deal is likely to be much trickier to achieve, as it will cover topics like intellectual property rights. Beijing can play the long game, so they are unlikely to concede too much to President Trump.” David Madden, analyst, CMC Markets

“The playbook for higher U.S. stocks seems etched in stone as investors brace for what could be second straight quarterly decline with earnings. Stocks should rally another 5 per cent this year since the Fed is on hold, the U.S.-China trade war will not fall off a cliff, Middle East tensions will remain, but unlikely yield a war, and the U.S. consumer remains strong.” Edward Moya, senior market analyst, Oanda

“[French] President Macron blinked. Faced with the longest, most disruptive, public sector strike since the 1930s, the leader dropped one of the tenets of his pension reform plans, which was to raise the retirement age from 62 to 64. PM Philippe announced on Saturday that the government will withdraw that proposal. Whether or not that will calm the unions is another story. The strikes continued on the weekend despite this change in plans.” Jennifer Lee, senior economist, BMO

Ticker

McCain criticizes U.S.

From Reuters: Maple Leaf Foods Inc. chief executive officer Michael McCain criticized the U.S. government for escalating tensions in the Middle East, after an Iranian missile accidentally shot down a Ukrainian airliner killing 176 people onboard, including an employee’s family.

“A MLF colleague of mine lost his wife and family this week to a needless, irresponsible series of events in Iran. U.S. government leaders unconstrained by checks/balances, concocted an ill-conceived plan to divert focus from political woes,” McCain said in a tweet posted on the company’s Twitter account on Sunday.

“The world knows Iran is a dangerous state, but the world found a path to contain it; not perfect but by most accounts it was the right direction,” he added in a series of tweets.

The CEO of the packaged meat producer said the tweets were his “personal reflections.”

Read more

Business outlook positive: BoC

From Reuters: Canada’s labour market is expected to tighten over the next year outside of the Prairie provinces, a Bank of Canada survey said, with some businesses now planning to add staff to meet supply and production demands. Results of the central bank’s quarterly business survey revealed business sentiment is broadly positive while expectations for future sales growth “remain positive.” The survey found business concerns around trade tensions had declined somewhat, with foreign demand, particularly from the United States, still lifting export prospects.

Brookfield eyes rest of TerraForm

From Reuters: Brookfield Renewable Partners said it would acquire the remaining 38 per cent stake in TerraForm Power Inc. it does not already own, in a deal that values the electricity utility at $3.93 billion, as it looks to boost its power portfolio. Brookfield Renewable said the all-stock offer represents an exchange ratio of 0.36 BRP units for each TerraForm class A share, valuing TerraForm at $17.31 per share. TerraForm said it has formed a special committee of non-executive, independent directors to review the unsolicited proposal it received on Saturday.

Renault shares sink

From Reuters: Renault shares hit six-year lows after a media report that Nissan has accelerated secret contingency planning for a potential split from the French car maker, the latest sign that the downfall of former boss Carlos Ghosn is roiling the 20-year alliance.

Saudis say they want stable prices

From Reuters: Saudi Arabia, OPEC’s de facto leader, will work for oil market stability at a time of heightened U.S.-Iranian tension and wants to see sustainable prices and demand growth, the kingdom’s energy minister said.

Also ...

What to watch for today

The Bank of Canada releases its widely watched business outlook survey, for the fourth quarter, which will feed speculation on the path and timing of interest rate changes, and a new survey of consumer expectations.

"The Bank of Canada’s winter business outlook survey (BOS), likely compiled from around mid-November to mid-December, is expected to show continued caution about the outlook," said BMO's Mr. Reitzes.

“Much of the Q4 data so far have been quite soft and it’s unlikely the survey picked up any of the time period after the positive U.S./China and USMCA results, suggesting sentiment will be steady to modestly weaker.”

What analysts are saying today

“Equity market sentiment in Europe this morning is positive as traders are looking ahead to the signing of the first phase of the U.S.-China trade deal on Wednesday. The largest economies in the world brokered phase one of the trade agreement at the back end of 2019, and it will be made official in two days’ time. International trade was a dominant theme of last year, but the U.S.-China trade story is far from over seeing as the second phase of the trade deal is likely to be much trickier to achieve, as it will cover topics like intellectual property rights. Beijing can play the long game, so they are unlikely to concede too much to President Trump.” David Madden, analyst, CMC Markets

Required Reading

Richardson rejects sale rumours

Richardson GMP Ltd., one of Canada’s largest independent wealth managers, is heading into 2020 with plans to double its client assets while debunking persistent rumours that the company is up for sale. Clare O’Hara reports.

Living up to standard

Alberta Premier Jason Kenney is not living up to his own standard on approving energy projects, columnist Jeffrey Jones argues.

Highest, lowest rated stocks

The list of equity analysts’ top Canadian stock picks for 2020 goes well beyond the usual suspects of bond proxies and big banks. Tim Shufelt takes a deep dive.