Recent economic data contains mixed messages, causing turbulence in the markets. Much of this centers on the health of the American consumer, who drives the U.S. economy.

First, the unemployment rate increased from 4.1% in June to 4.3% in July, causing many prognosticators to discuss a potential recession. The market dipped as a result. Next, data came out that unemployment claims actually fell, indicating a more resilient jobs market.

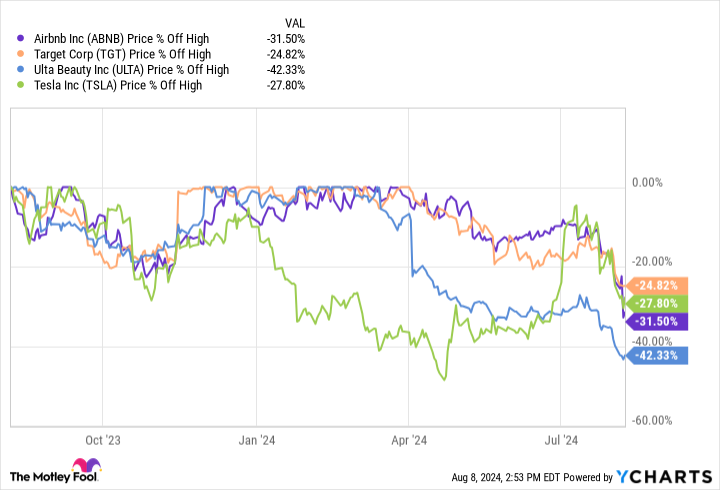

As a result of concerns over consumer spending and some modest results, Airbnb(NASDAQ: ABNB) joined retail stocks like Target, Ulta Beauty, Starbucks, and even Tesla as Wall Street sold off the stock heavily.

What's an investor to do? Was the sell-off of Airbnb justified or shortsighted? As always, keep calm and invest in terrific companies for the long haul.

Why did Airbnb stock drop so much?

There were three primary reasons for the stock's sell-off: the macroeconomic concerns discussed above, slowing growth; and tepid guidance.

Airbnb enjoyed significant growth as we emerged from the pandemic due to pent-up travel demand and economic stimulus. People were itching to travel and had the money to make it happen. But this appears to be waning. As shown below, there was a significant drop in the second quarter.

Data source: Airbnb. Chart by the author.

Management forecasts third-quarter growth to continue trending down, with revenue growth of 8% to 10%. It's easy to see why Wall Street is concerned. However, there are other factors for investors to consider.

Is Airbnb stock a good investment?

Airbnb features a tremendous business model. The platform is efficient, allowing Airbnb to produce remarkable free cash flow. The free cash flow margin over the past 12 months is 41%, which is fantastic. This means that for every $1 in sales, $0.41 drops into the company's pocket. Trailing 12-month free cash flow has increased 743% to $4.3 billion since the beginning of 2021, while revenue increased 207% to $10.5 billion.

ABNB Free Cash Flow data by YCharts.

The rapid rise indicates that Airbnb's business model is incredibly efficient, which benefits shareholders. Airbnb returns much of this capital to investors through stock buybacks. Buybacks decrease the number of shares available on the open market, increasing the remaining shares' ownership interest.

Airbnb repurchased $749 million worth of shares in Q2 and $2.75 billion over the past 12 months, amounting to nearly 4% of the current $72 billion market cap. The company has authorized $5.25 billion more stock repurchases. With this authorization, more than 7% of shares can be taken off the market at the current stock price. As a result, the stock price could climb quickly once the market turns bullish again.

The stock currently trades near its lowest ever price-to-earnings ratio and more than 30% lower than competitor Booking Holdings, as shown below.

ABNB PE Ratio data by YCharts.

While there is much to like about Airbnb as a long-term investment, the short-term road could be rocky. Wall Street doesn't like slowing growth, even when overall results are good and the cash is flowing. It's also possible that the U.S. will go into recession, and people will cut back even more on spending, pushing the stock down further.

On the other hand, anticipated rate cuts from the Federal Reserve could spur a rally in the markets, and a recession is not a given. Patient investors should consider picking up shares for the long haul.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $668,029!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Bradley Guichard has positions in Airbnb, Starbucks, and Ulta Beauty. The Motley Fool has positions in and recommends Airbnb, Starbucks, Target, Tesla, and Ulta Beauty. The Motley Fool has a disclosure policy.