Intel(NASDAQ: INTC) has been the rare semiconductor stock that has faltered this year. In fact, as of Friday, Intel was down 34% for 2024, even as the one of the largest semiconductor sector exchange-traded funds (ETFs) was up 42%. And the trend over the past five years has been even worse, with Intel's underperformance compounding to ghastly levels:

INTC Year to Date Total Returns (Daily) data by YCharts

However, the company has recently issued positive updates on CEO Pat Gelsinger's ambitious turnaround plan, which began in 2021 and should reach the end of its first stage by next year. In recent months, Intel also issued a long-term financial model that goes out to 2030.

If management keeps executing and hits its 2030 goals, that would make the stock very, very cheap at current levels.

Five nodes in four years, while building a foundry

Intel's ambitious turnaround has two main-components: becoming the technology leader again for its own products, and opening up its internal fab to external customers to compete with Taiwan Semiconductor Manufacturing(NYSE: TSM). But both of these goals center on the same premise: regaining manufacturing leadership for leading-edge nodes.

That requires a lot of investment and success in chip design. Another obstacle making things more difficult: Intel's main cash-cow businesses in PC CPUs and traditional server CPUs have been depressed for the past couple of years following the pandemic.

But for the things it can control, Intel has impressed. The company qualified to receive helping funds from the U.S. government via the CHIPS Act passed in late 2022, and lured in co-investments from big-name investors Brookfield Infrastructure Corporation and private equity firm Apollo Global. Additionally, Intel has even gotten some customers to pre-pay for its upcoming 18A node, which will be in production later this year.

18A is important, as the fifth node of the four-year plan, when management believes it will match TSMC's capabilities. Microsoft(NASDAQ: MSFT) recently became the most prominent company to announce it would become a customer of 18A, announcing that in February.

Meanwhile, technology execution has been good. In June, Intel announced it had gotten its Intel 3 node, introduced late last year and the third node of the five-node plan, into mass production on schedule. Intel 3 is a 3nm node, equivalent to what TSMC first produced last year. But Intel's 20A and 18A nodes are following close behind, set for their first production later this year and mass production next year.

Intel's 2030 model

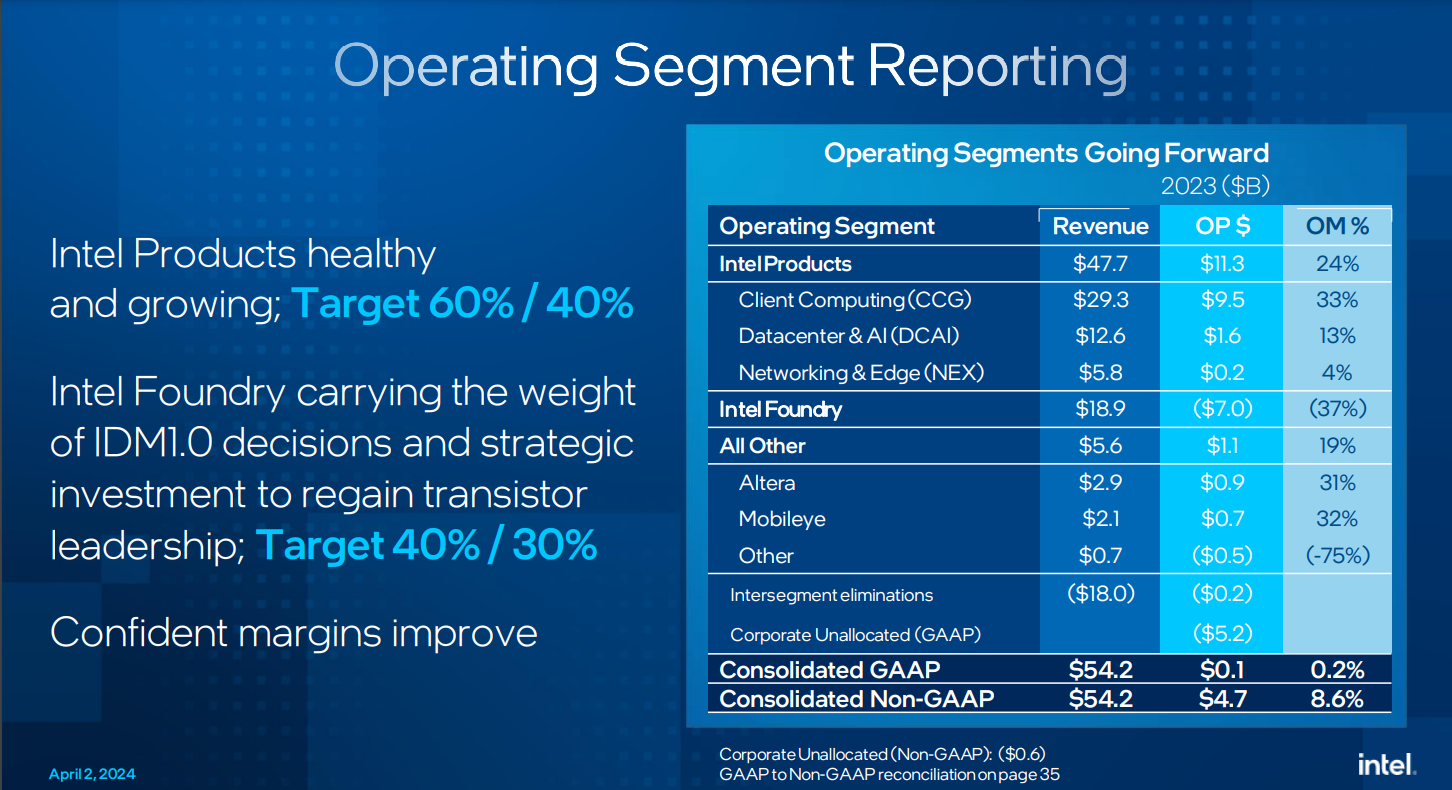

This year, Intel began separating out the internal foundry from its "Intel Products" division, or its in-house designed chips, calculating Products margins as if the Products segment were a third-party fabless company. As you can see, that business has a relatively high 24% operating margin, even though Intel's chips are currently on lagging-edge technology.

However, the internal Foundry segment, when separated, shows a massive $7.0 billion loss. That probably spooked investors, as Intel's stock declined in the days after the April 2 presentation.

Image source: Intel.

Yet Intel has already booked $15 billion in cumulative lifetime value from third parties as of April, and that revenue hasn't shown up yet. As these customers scale, Intel sees the Foundry segment breaking even by 2027, eventually reaching a target of 30% operating margin by 2030, with annual revenue greater than $15 billion.

Meanwhile, Intel's Products are forecast to get back to a 40% operating margin, where the company was back when it had process leadership. That should lead the overall company to a 35%-40% operating margin by 2030, with reasonable revenue assumptions. In a recent investor presentation, Intel's director of investor relations provided a model of about $100 billion in total revenue by 2030, based on reasonable industry growth prospects and regaining some market share Intel has lost.

Intel's products will still take up the vast majority of its revenue if the external Foundry is at $15 billion in revenue, leaving about $85 billion for Intel Products revenue. Of note, Intel had $47.7 billion in Products revenue last year, even in a soft year for PCs and on lagging process technology. So that is really not that ambitious of an assumption in seven years' time.

Cheap for 2030

Assuming Intel can hit these targets, which management has called reasonable and conservative, that would yield between $35 billion and $40 billion in 2030 operating income.

Intel's market cap is only $140 billion today, which means if the company executes on this expensive and complicated turnaround, the stock is quite cheap, going for less than four times its potential 2030 operating income.

Of course, the big questions around execution and the economic climate from now until then is are what's keeping the price down. But for optimists looking for cheap ways to play AI, this is a turnaround that may just be worth investing in.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Billy Duberstein and/or his clients have positions in Intel, Microsoft, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Microsoft and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.