Over the past couple of years, PDD Holdings (NASDAQ: PDD), managed to defy a weakened Chinese e-commerce market and put up stellar growth (even as rivals struggled). It was only after the company reported second-quarter earnings results that warned of challenges ahead that the stock price took a hit.

Let's take a closer look at the company's earnings as well as other issues involving PDD to see if investors should buy this latest dip or stay away.

Strong revenue growth, but challenges ahead

For its second quarter, PDD reported a revenue jump of 86% year over year to $13.4 billion. Revenue from transaction services surged 234% to $6.6 billion, while revenue from online marketing rose 29% to $6.8 billion.

Transaction services include revenue from international marketplace Temu and its DuoDuo grocery business. The segment has gone from being just 15% of its revenue back in 2021 to nearly half last quarter. The company has not broken out how much of its revenue comes from either of these two businesses or if they are close to profitability.

Gross margin improved to 65.3% from 64.3% a year earlier. Profitability increased more than revenue with operating profits soaring 156% to $4.5 billion, while adjusted earnings per American depositary share (ADS) soared to $3.20 from $1.44 in the year-ago quarter.

Looking ahead, though, the company warned investors that its high revenue growth was not sustainable and that profitability would fall. The company said it was seeing intensified competition and that consumer preferences were changing. Alibaba(NYSE: BABA) and JD.com(NASDAQ: JD) have put a lot of effort into trying to challenge PDD's Pinduoduo platform and lure merchants and customers to their offerings, so these efforts may finally be impacting PDD.

The company said it was transitioning to a new investment phase focused on supporting high-quality merchants and improving its supply chain. It would invest $10 billion in these efforts over the next year as it reduces fees for quality merchants. It is also working with high-quality brands and manufacturers to create customized products. At the same time, it will look to weed out bad merchants from its platform.

As for Temu, which the company referred to as its global business, it said it is seeing increased competition and greater uncertainty. It also noted that its operations are being impacted by non-business factors.

Image source: Getty Images.

Should investors buy the dip?

Alibaba and JD.com have put a lot of effort into trying to challenge PDD's Pinduoduo platform and lure merchants and customers to their offerings, so these efforts may finally be impacting PDD. The two have always had the more quality merchants on their platforms, and JD.com still sells most of its goods direct, but PDD has always undercut them on price. The two previously reduced fees and worked to improve their merchant experiences as well.

With PDD lowering fees and looking to improve merchant quality, it now looks like an all-out pricing war is taking hold in the Chinese e-commerce space.

Temu, meanwhile, has had a lot of scrutiny around it for a while. Members of Congress have long scrutinized the company over alleged slave labor being used to produce goods on its platform as well as gathering data on its U.S. customers. Some government officials have asked for the company to be banned in the U.S.

In addition, both the U.S. and Europe have been considering stricter import duties around the site. The company is also having problems with its suppliers over its policies, including levying them with fines. Suppliers recently protested outside its headquarters as a result. To add to the fire, it and rival Shein are also in a nasty lawsuit in which each accuses the other of many illegal and unethical actions.

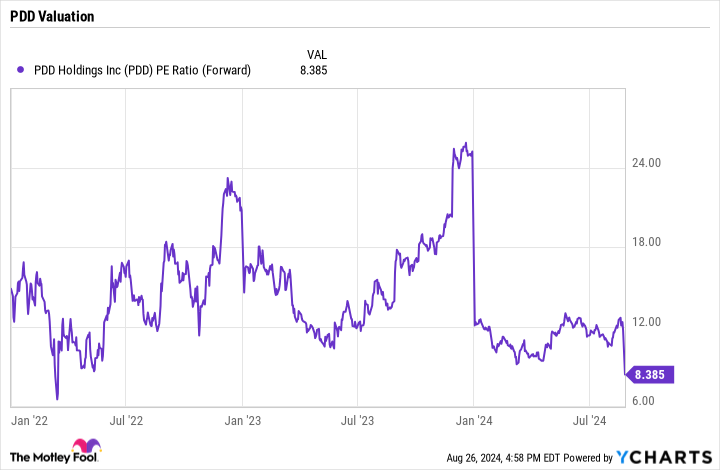

From a valuation perspective, the company trades at a forward price-to-earnings (P/E) ratio of only 8.4 times.

PDD PE Ratio (Forward) data by YCharts

That's incredibly cheap, especially given its revenue growth. However, this company has long lacked transparency and is now dealing with a lot of issues.

I wouldn't be enticed by its seemingly cheap valuation and would stay away from the stock.

Should you invest $1,000 in PDD Holdings right now?

Before you buy stock in PDD Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PDD Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Geoffrey Seiler has positions in Alibaba Group. The Motley Fool has positions in and recommends JD.com. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.