Beverage titan Coca-Cola(NYSE: KO) is on a roll. The stock is trading near all-time highs after gaining 22% in 2024.

The steep price gains made many investors stop and reconsider Coke's stock. Is there any room for further growth at this point, or is it just too late to invest in Coca-Cola stock today?

I see many reasons to get into Coca-Cola's stock today. The active growth catalysts include marketing and distribution campaigns based on artificial intelligence (AI) analytics, the reformulation and relaunch of many popular drink brands in specific markets around the world, and innovative partnerships with other household-name brands.

Coca-Cola's marketing efforts are also quite effective. Trailing twelve-month sales are up 12.5% over the last two years, and the company is achieving this growth while maintaining market-leading profit margins.

Coke's recipe for success: Unbeatable profit margins

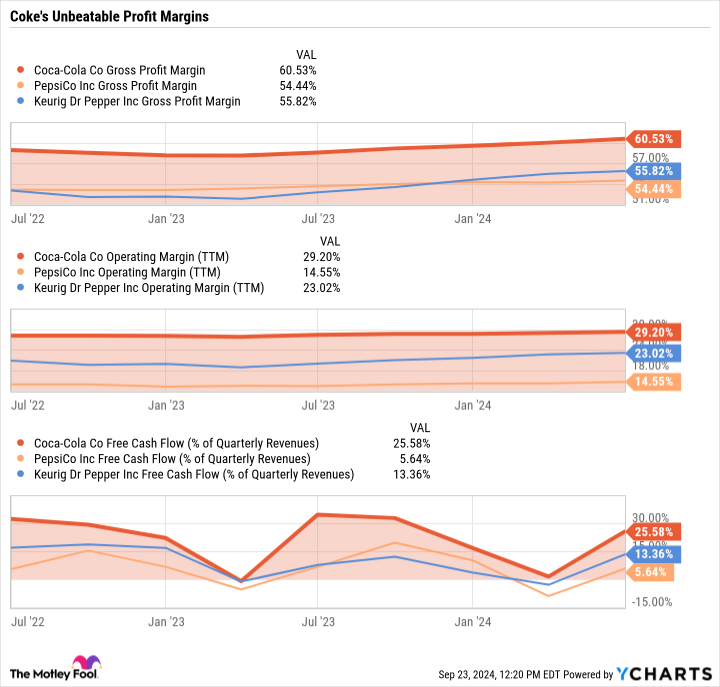

That's the point here. Whether you're looking at fundamental gross margins or efficiency-based operating margins, Coca-Cola leaves chief rivals PepsiCo(NASDAQ: PEP) and Keurig Dr Pepper(NASDAQ: KDP) far behind. Coke also doubles the free-cash-flow margins of the runner-up, Keurig Dr. Pepper:

KO Gross Profit Margin data by YCharts. TTM = trailing 12 months.

As you can see in the charts above, Coke's rivals are eating dust. Keurig Dr. Pepper is gaining some ground but has a long way to go. Pepsi's more capital-intensive business model wasn't designed for high-margin operations.

Coke's unchallenged profit margins prove the company has a high-quality business plan with strong pricing power and a top-notch management team. The top-line growth and industry-leading margins should stay intact for years to come, boosted by an open-minded approach to new ideas such as AI tools and new flavor recipes.

So, Coca-Cola's stock sells at a mild premium to Pepsi or Keurig Dr. Pepper, but for all the right reasons. You should pay a bit more for a true market leader. If you buy some Coke stock today, you should be able to hold it for decades with good results.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.