As tensions continue to run high in multiple areas around the globe, the goods and services of defense companies will, undoubtedly, remain in high demand.

Of the many choices, two common considerations that are often found on the radars of those seeking a defense investment are RTX(NYSE: RTX) and LockheedMartin(NYSE: LMT). Let's see how two fool.com contributors break down the bull cases for each stock.

This aerospace and defense giant's prospects are improving

Lee Samaha(RTX): While I don't think RTX is particularly undervalued right now, it has good earnings growth prospects, a useful 2.2% dividend yield, and a solid mix of businesses. The mix of defense and aerospace businesses has worked well in recent years, with the cash flows from defense helping RTX's commercial aerospace businesses overcome severe challenges during the lockdown periods.

It's a critical point given the nature of both businesses. For example, it takes years of investment to produce airplane engines or defense equipment, and a steady stream of cash flow is necessary to secure investment. As such, RTX is a relatively secure business. Its Pratt & Whitney segment, which makes airplane engines, has a long-term income stream from lucrative aftermarket revenue from servicing engines. Meanwhile, Collins Aerospace is a leading original equipment and aftermarket supplier to the aerospace industry.

While there are question marks around the Raytheon defense-focused segment's profit margin and overall defense industry margins, there are none around Raytheon's current backlog of $51 billion. For reference, Raytheon's sales were $26.4 billion in 2023, and the book-to-bill ratio at Raytheon was 1.13 over the past 12 months to the end of the second quarter.

Everything points to a period of solid growth, notably as Pratt & Whitney moves past the GTF engine inspection issue.

Wall Street analysts see RTX's earnings growing at a 10% rate over the next few years. With a 2.2% dividend yield, the stock could generate decent returns for investors over the long term.

Come for Lockheed Martin's dividend and stay for the valuation

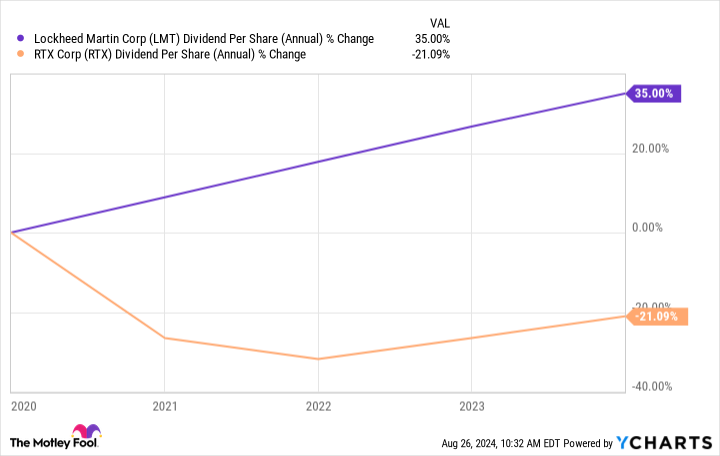

Scott Levine (LockheedMartin): It's not only the fact that Lockheed Martin's dividend now offers a forward yield of 2.3%. The company has shown a quality that is lacking in RTX: consistent dedication to raising the dividend higher, a desirable quality for defense investors looking to boost their passive income.

LMT Dividend Per Share (Annual) data by YCharts.

Lockheed Martin's allure, however, transcends the growing payout. It has done so without imperiling the company's financial health. Over the past five years, Lockheed Martin has averaged a conservative 47% payout ratio. On the other hand, RTX has averaged a more concerning 101% payout ratio during the same period.

Coming off a strong first half of 2024, Lockheed Martin upwardly revised its 2024 guidance recently. Whereas it had originally forecast 2024 revenue of $68.5 billion to $70 billion, it now expects to post sales of $70.5 billion to $71.5 billion. Management foresees better results at the bottom of the income statement as well, raising its diluted earnings per share (EPS) outlook to $26.10 to $26.60 from $25.65 to $26.35.

A leader in defense solutions, Lockheed Martin has also paid considerable attention to the final frontier, making it a top choice for investors looking to gain exposure to the burgeoning space economy. Growing its position even further, Lockheed Martin announced its planned acquisition of TerranOrbital, a satellite manufacturer. The transaction, expected to close in the fourth quarter of 2024, is valued at $450 million, considerably less than the $600 million offer that Lockheed Martin had previously made.

Lockheed Martin's stock isn't a screaming buy now, but it's valuation is certainly attractive. Lockheed Martin stock is currently trading at 20.2 times trailing earnings, a steep discount to RTX's P/E of 68.5. Similarly, Lockheed Martin is valued at 16.1 times operating cash flow whereas RTX stock has a cash flow multiple of 27.7.

Should you buy these stocks now?

Both RTX and Lockheed Martin are compelling options for investors looking to fortify their portfolios with a compelling defense stock. For those who'd also be happy to have a top space stock among their holdings, Lockheed Martin will shine brighter than RTX, while those who are interested in a more concentrated defense contractor will be drawn to RTX.

Should you invest $1,000 in Lockheed Martin right now?

Before you buy stock in Lockheed Martin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lockheed Martin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $774,894!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin and RTX. The Motley Fool has a disclosure policy.