If there's one thing that's characterized the current bull market, it's the rise of big tech stocks leading the next generation of artificial intelligence (AI) innovation. Capital has piled into the biggest names in the market, including Nvidia, Microsoft, Alphabet, Amazon, and Meta Platforms. All five have played significant roles in the advancement of AI, and together, they account for 63% of the S&P 500's returns through the first half of 2024.

As a result of the meteoric rise of the world's biggest companies, market concentration is near levels investors haven't seen since the 1970s. While those big AI tech companies have produced solid earnings results, propelling their stocks higher, market concentration has historically always reversed course. One market indicator suggests the market may be about to broaden out.

Image source: Getty Images.

U.S. money supply is finally growing again

Decelerating growth in money supply is typically tied to an increase in market concentration among a few large stocks, according to Khuram Chaudhry, head of European Quantitative Strategy at J.P. Morgan.

Think about it from the perspective of a business owner: If the money supply is tight, there's less access to cash to grow your business. If you're a very large business already, though, you can produce enough cash from operations that you don't need to worry about outside funding. Investors understand this dynamic, and the big get bigger. That trend is exacerbated by the high capital requirements of building an AI business, which is what's currently driving the bull market.

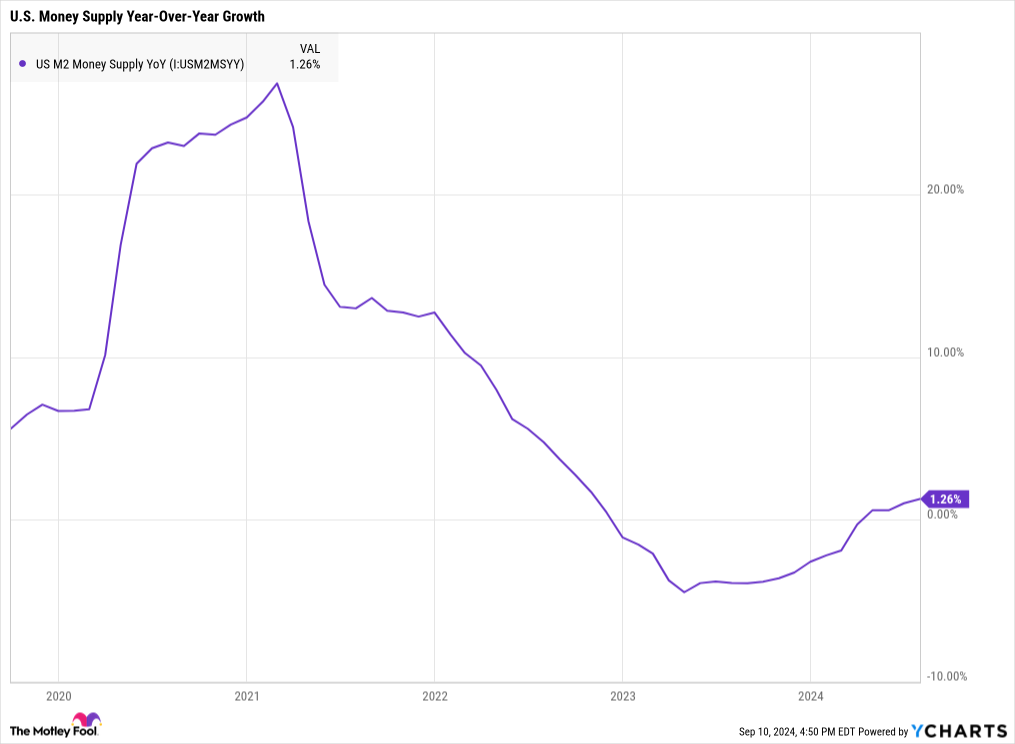

The money supply grew quickly in 2020 as the government injected cash into the economy with stimulus checks, and the Federal Reserve cut interest rates to 0%. Starting in 2021, we saw the after-effects of those policies start to take hold. We naturally saw slower growth, as measured by the U.S. M2 money supply. M2 includes cash in circulation, deposit accounts, money market accounts, and certificates of deposit. Basically, any money that's easily accessible to businesses and consumers.

As the Fed continued to raise interest rates and put further control on the money supply in an effort to curb inflation, we saw M2 money supply growth dip into negative territory by the end of 2022. It stayed that way through the first quarter of 2024.

But the money supply is finally growing again, and its growth is accelerating. In April and May, the M2 money supply grew 0.6% year over year. That climbed to 1% in June and 1.3% in July.

US M2 Money Supply YoY data by YCharts.

We could see further acceleration through the end of the year. The Federal Reserve is widely expected to announce its first rate cut of the cycle this month when the Federal Open Market Committee (FOMC) concludes its September meeting. As of this writing, over 90% of futures traders currently expect the Fed to cut rates by at least 1 percentage point by the end of the year.

Based on Chaudhry's analysis, as money supply growth accelerates, we should see a broadening of the market. There are three great exchange-traded funds (ETFs) investors can use to take advantage of the easing money supply.

1. Schwab Fundamental U.S. Large Company ETF

The Schwab Fundamental U.S. Large Company ETF(NYSEMKT: FNDX) is an interesting index fund. It follows an index that ranks and weights securities by fundamentals -- adjusted sales, operating cash flow, and cash returned to shareholders -- instead of by market capitalization like the S&P 500. The result is much less portfolio concentration than a standard S&P 500 index fund, making it a great way to invest in the market broadening without taking on a portfolio that deviates too far from other large-cap index funds.

Big companies like Apple, Microsoft, and Berkshire Hathaway still make up a good chunk of the portfolio (about 9.3% as of this writing) but far less than in an S&P 500 index fund. (Those stocks account for 15.3% of the S&P 500.)

The Schwab Fundamental index fund is effectively a contrarian investment. When the fund rebalances its holdings, it puts more money into stocks with declining prices relative to their fundamentals while selling those that have gotten ahead of the fundamentals. That effectively weights the fund more toward large-cap value stocks.

With an expense ratio of 0.25%, the fundamental index fund isn't the cheapest way to invest in index funds. But investors should see the less-concentrated fund outperform the top-heavy S&P 500 while maintaining decent exposure to the biggest companies by fundamental measures.

2. Invesco S&P 500 Equal Weight ETF

The Invesco S&P 500 Equal Weight ETF(NYSEMKT: RSP) tracks the S&P 500 equal-weight index. Instead of weighting each component of the S&P 500 by market cap, the equal-weight index fund simply invests an equal amount in each stock. That means the returns produced by the smallest stocks are just as important as the returns produced by Apple, Microsoft, and Nvidia.

The index gets rebalanced every quarter when the S&P 500 updates its constituents. That ensures the index fund never strays too far from its equal-weight goal.

The equal-weight index historically outperforms the cap-weighted S&P 500 over the long run. Since the Invesco fund's inception in 2003, it's produced an average compound annual return of 11.63% versus 11.06% for the S&P 500. That said, the fund has significantly underperformed over the past three- and five-year periods. Its long-term success can be attributed to its diversification.

The equal-weight index fund will outperform if the market broadens. Smaller companies will outperform the larger companies in the S&P 500, and the equal-weight index will benefit as a result. With an expense ratio of 0.2%, it's an inexpensive way to invest in large-cap stocks as money supply growth accelerates.

3. SPDR Portfolio S&P 600 Small Cap ETF

The SPDR Portfolio S&P 600 Small Cap ETF(NYSEMKT: SPSM) tracks the S&P 600. The S&P 600 is similar to the S&P 500 but focuses on small-cap stocks. The index consists of about 600 consistently profitable U.S. businesses with market caps ranging from around $150 million to $8.8 billion.

The S&P 600 is a bit different from other small-cap indexes like the Russell 2000 because it has a profitability requirement. As a result, the constituents of the index lean toward value stocks. Small-cap value stocks have historically outperformed every segment of the market over the long run. And as money supply growth accelerates, they could be set up for another period of outperformance.

The S&P 600's valuation is also extremely attractive right now. As big tech stocks with high valuations have grown to dominate the S&P 500, it's aggregate forward price-earnings ratio has climbed to 20.2 times. Meanwhile, the S&P 600 has a total forward price-to-earnings ratio of just 14.5. That valuation gap is one of the highest in decades, and it makes the small-cap index extremely attractive.

The Invesco S&P 600 index fund is extremely inexpensive, with an expense ratio of just 0.03%. So, if you expect easier access to capital to be a big boost to small-caps, it could be one of the lowest-cost ways to invest in an undervalued part of the market.

Should you invest $1,000 in Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Adam Levy has positions in Alphabet, Amazon, Apple, Meta Platforms, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.