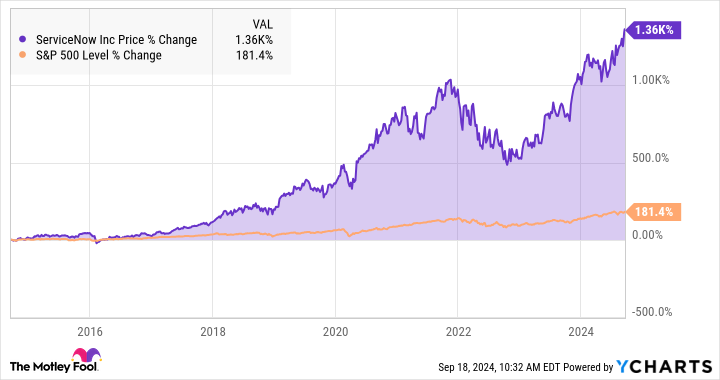

Workflow automation specialist ServiceNow(NYSE: NOW) is crushing the market. The stock has more than doubled in two years while the S&P 500 market index rose by 45%.

From a longer perspective, ServiceNow investors enjoyed gains of 1,360% over the last decade, far ahead of the broader market's 181% gains. The artificial intelligence (AI) boom is working wonders for this company, with services that are built around advanced AI automation:

That's great for longtime shareholders, but new investors may be discouraged by ServiceNow's high share prices. The company has never performed a stock split, so these shares trade at $890 per share today.

Is it time for ServiceNow to announce its first-ever stock split? Let's review the pros and cons of taking that step.

Why stock splits matter

Stock splits serve three primary purposes:

- A lower price makes the stock more accessible to some investors. When your investment budget is low and you don't have access to trading fractional shares, it can take time to save up for the purchase of a single high-priced stub.

- Stock-based compensation is one important example of this effect. For companies that make heavy use of issuing stock options to their employees, a lower price provides management with more granular control over this partial paycheck replacement. A single option contract relates to 100 shares of the underlying stock, and that adds up in a hurry when each share is worth nearly $1,000.

- Stock splits convey the message that the company's leaders expect share prices to rise even higher. This is a vote of confidence for the company's business prospects and financial strength -- think of it as a low-cost marketing move.

That's about it. Stock splits don't create additional value for new or existing shareholders since they simply divide up the same pie of ownership into a different number of slices. The total portion on your plate remains the same.

ServiceNow's flexible approach to stock-based compensation

ServiceNow relies on stock-based compensation. In the second quarter of 2024, 18.6% of the company's operating expenses and cost of revenue consisted of share-based compensation.

The stock price does affect ServiceNow's employee compensation policies to some degree. A lower price gives its managers and board of directors more detailed control over how much each worker or executive is paid.

That being said, this company doesn't always issue options. According to ServiceNow's financial filings, some of these awards are issued in the form of call option contracts, while others are restricted stock units with time-based vesting schedules. This best-of-both-worlds approach lowers the impact of rich share prices and stock-splitting ideas, compared to a company with a stock-based compensation system based strictly on stock options.

Why this isn't the best time for a ServiceNow stock split

ServiceNow has posted stellar stock gains for 12 years but never bothered to do the stock-split macarena. There may be some practical benefits from lowering that beefy stock price, but it's not something that comes up often (or ever) in the company's earnings calls.

A 10-for-1 stock split would drop ServiceNow's share price below the $100 mark while giving investors a public show of swagger and confidence. Would that be helpful?

Well, the stock already trades near all-time highs. Trailing sales have nearly doubled (up 93%) in three years. The company generated $3.1 billion in free cash flow from $10 billion of top-line sales in the last four quarters.

ServiceNow doesn't need to go fishing for investor approval in order to boost the stock's valuation ratios. Shares are already changing hands at the lofty valuation of 161 times earnings and 59 times free cash flow. Asking for more is a stretch at this point.

At a glance, ServiceNow may look like an obvious stock-split candidate, but I'm not so sure that a split would do much for the company. A spotlight-stealing show of confidence could be more helpful if the soaring stock slides back a bit. At that point, a split could boost both investor and employee morale.

However, that's not what's going on today, and I'd be shocked to see ServiceNow announce a stock split under these circumstances. The answer could change if the stock ever takes a steep price cut, preferably for no good reason.

Should you invest $1,000 in ServiceNow right now?

Before you buy stock in ServiceNow, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ServiceNow wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ServiceNow. The Motley Fool has a disclosure policy.